Data Monetisation Frontiers the Retail Sector

Data is being created and transferred at an unprecedented rate, fuelling the growth in business intelligence and analytics BI&A.

Primarily for the discovery of opportunities to optimise supply chain collaboration, improve supplier and customer ecosystems and the development of new product and services.

Potential buyers of retailer's data include direct suppliers, data aggregators, analytics service providers, and even competitors.

Three major trends are enhancing the potential for data monetisation in the retail space, Big Data, BI&A, and the Cloud.

Cloud-based and BI&A platforms allow retailers and their suppliers to share data and analytics, often for a price.

Retailers may also monetise their data by exchanging it for other benefits e.g. merchandising benefits. Download our opinion piece “Advanced Analytics at Scale! Concept or Reality?

Data Applications in the Retail Sector

Point of sale, consumer -loyalty and inventory data can be sold to suppliers and some of the cost of analysing a retailer’s data may be recovered from its suppliers.

Suppliers incumbent within a supply chain may also be privy to sales data. Conferring on them the ability to more accurately forecast demand and predict inventory levels.

The incorporation of just in time practices may enable retailers to adopt assembly to order processes.

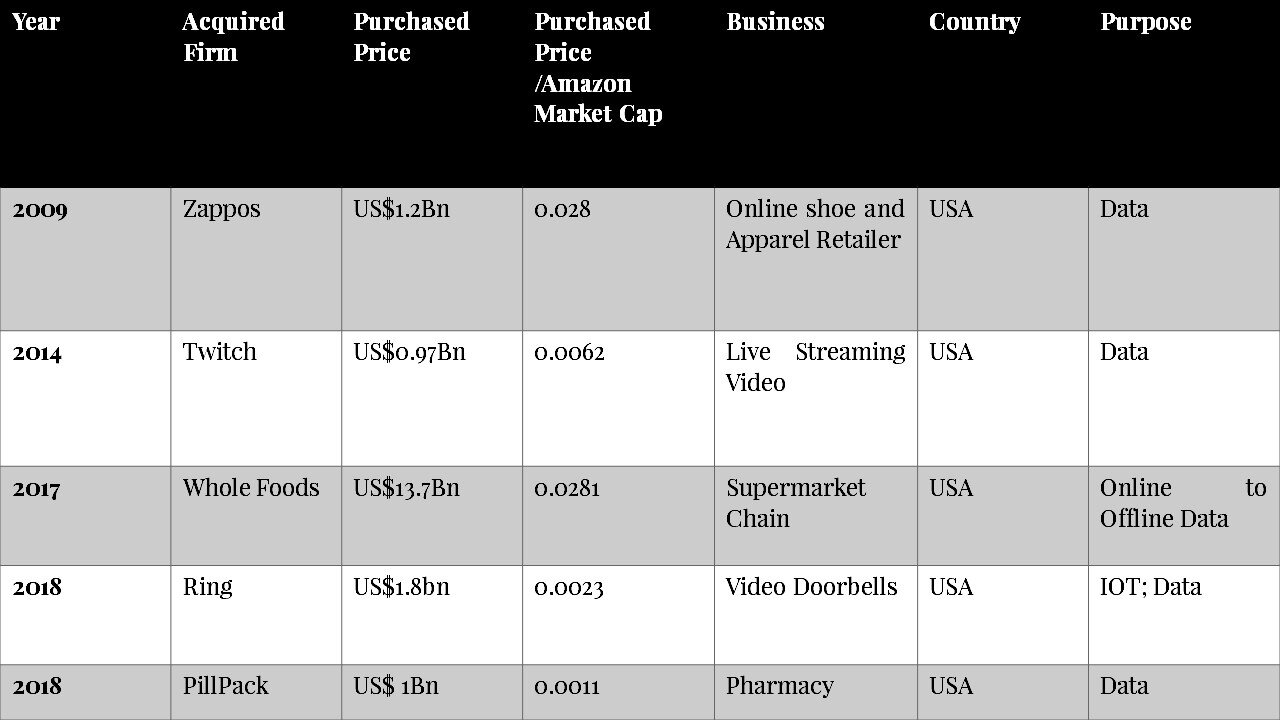

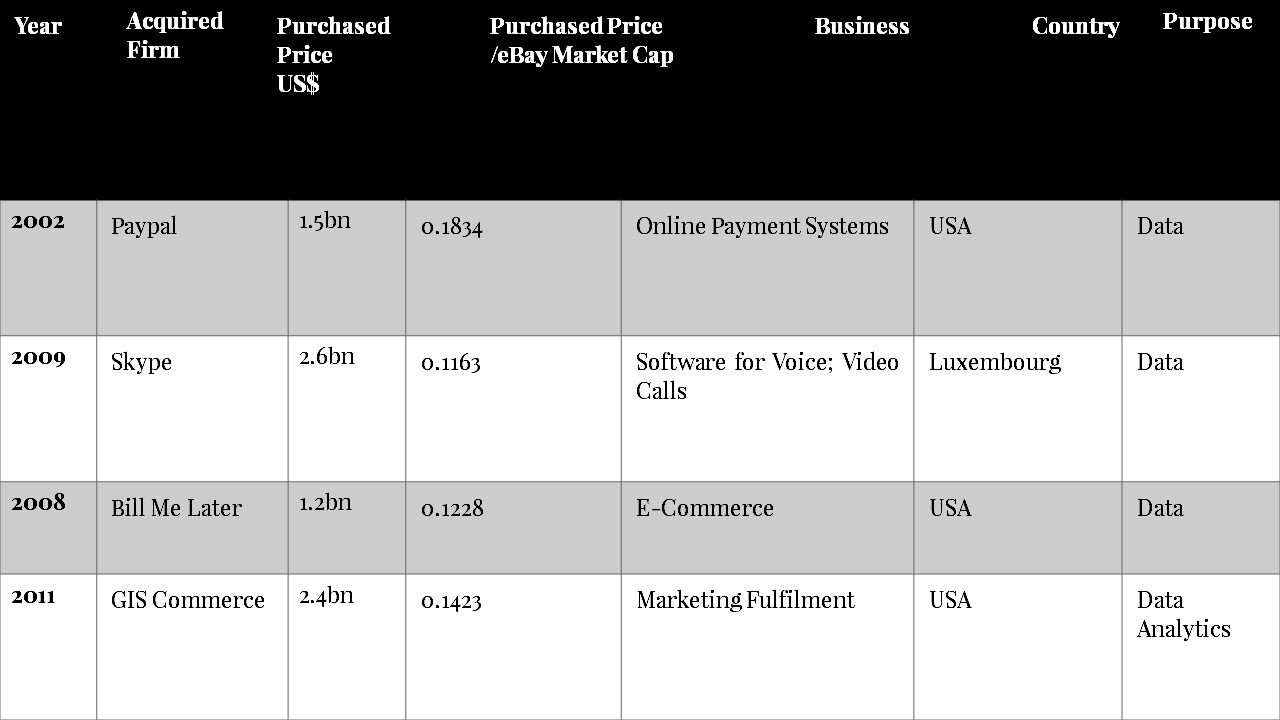

From a strategic perspective, this data may be deployed for the identification of complementary products, and potential merger and acquisition decisions.

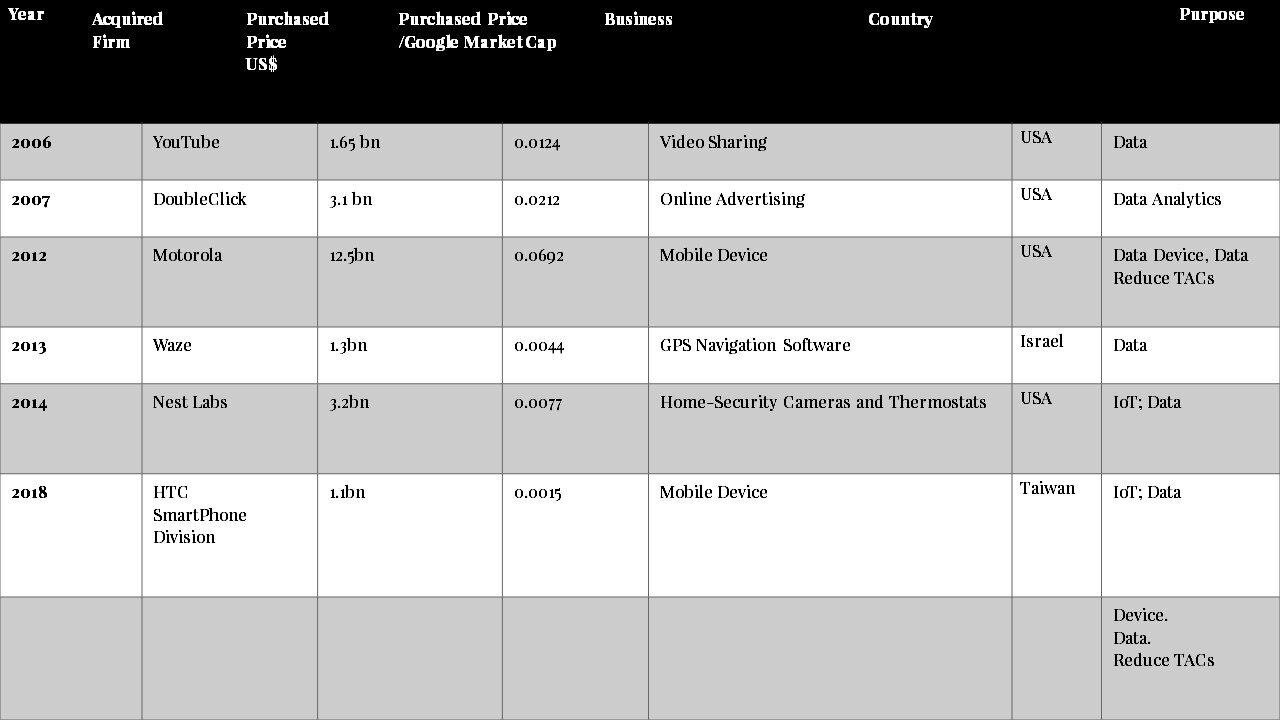

View our blog post “The Data Driven Economy” to see how the most valuable companies use data at the core of their businesses.

There are four pathways a company may follow to data monetisation.

Build both capabilities internally or hire a third party

Acquire data to leverage your analytical capability

Build technical data infrastructure first and

Monetise and dig deeper collectively as partners.

Valuing Data in a Rapidly Digitising World

For organisations to truly realise the value of this intangible asset, and thus engage in activities that enhance the quality of information. They must apply a monetary value to data. That will increase or diminish in response to how information is managed.

This may be through combining the data with other 3rd parties of identifying data asymmetries that enable a firm to exploit market opportunities.

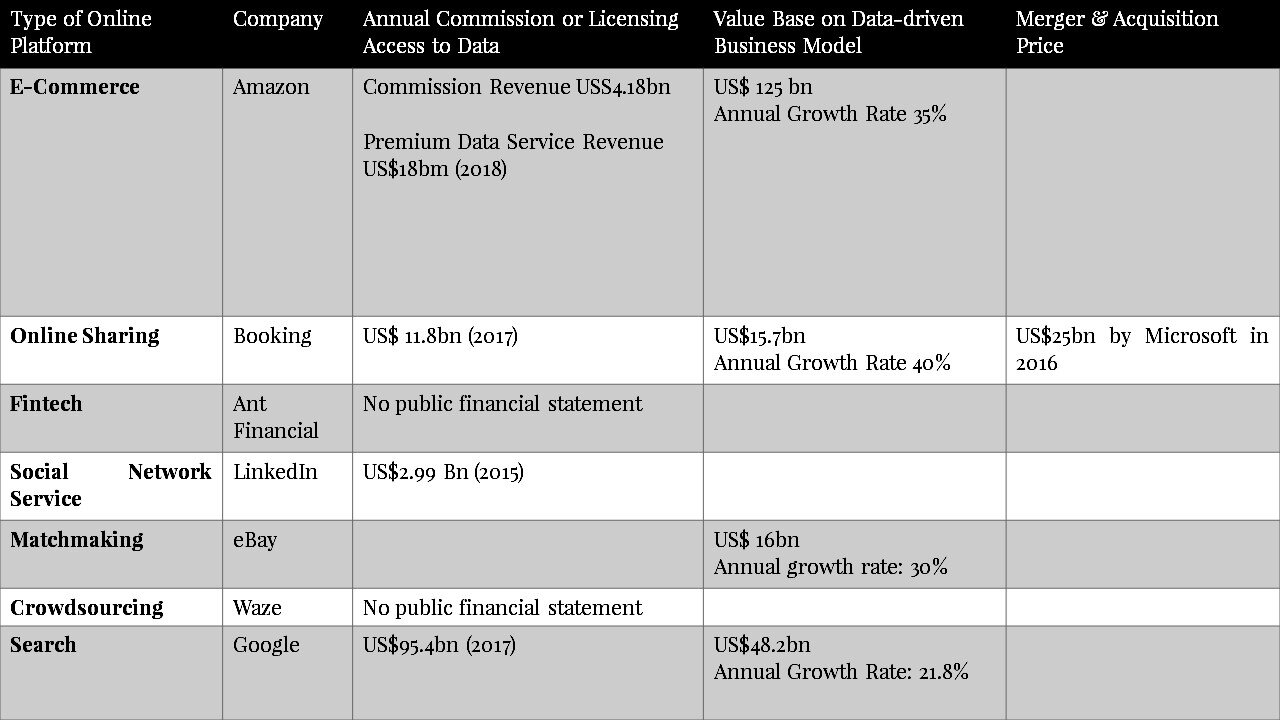

For additional information view the blog post “Online Platforms the Data and Insight Engines of the Digital Economy”

One way in which data owners can determine the importance of the information traversing their ecosystems may be expressed in terms of cost and consumption.

That is the cost of capturing, cleaning, storing and analysing the data.

The level of consumption by internal and external parties and the value generated by the interactions.

The Seven Laws Governing Information

Measuring the Value of Data

Applying a monetary value to one of the least well-managed assets, owned by corporations.

Will be essential as more businesses, business models and consumers conduct a significant part of their activities online.

Capital markets are finding ways to value companies that own proprietary data in a rapidly digitising world.